Exploring the realm of AARP secondary insurance to Medicare opens doors to enhanced coverage and benefits, shedding light on the symbiotic relationship between the two. Dive into the intricacies of how these programs work together to provide comprehensive healthcare solutions.

This topic delves into eligibility criteria, coverage details, cost implications, and provider accessibility, offering a holistic view of how AARP secondary insurance complements Medicare.

Overview of AARP Secondary Insurance to Medicare

When it comes to healthcare coverage, AARP secondary insurance plays a crucial role in complementing Medicare benefits, providing additional support and coverage for various medical expenses.

Benefits of AARP Secondary Insurance

- Extended Coverage: AARP secondary insurance offers additional coverage beyond what Medicare provides, filling in the gaps and ensuring more comprehensive healthcare protection.

- Cost Savings: With AARP secondary insurance, individuals can save on out-of-pocket costs such as deductibles, copayments, and coinsurance, making healthcare more affordable.

- Access to Additional Services: AARP secondary insurance may offer access to services not covered by Medicare, such as vision, dental, and hearing care, enhancing overall healthcare benefits.

How AARP Secondary Insurance Works Alongside Medicare

AARP secondary insurance typically coordinates with Medicare by covering costs that Medicare does not, acting as a supplementary plan to ensure comprehensive coverage for healthcare needs. Individuals with both AARP secondary insurance and Medicare can enjoy the combined benefits of both plans, providing a more robust safety net for medical expenses.

Eligibility and Enrollment Process

To be eligible for AARP secondary insurance to Medicare, individuals must already be enrolled in Medicare Part A and Part B. This secondary insurance offered by AARP is designed to supplement the coverage provided by original Medicare.

Eligibility Criteria

- Individuals must be at least 65 years old to qualify for Medicare.

- Enrollment in both Medicare Part A and Part B is mandatory to be eligible for AARP secondary insurance.

Enrollment Process, Aarp secondary insurance to medicare

- Visit the official AARP website or contact their customer service to inquire about enrolling in their secondary insurance.

- Fill out the necessary forms and provide the required information, including your Medicare details.

- Choose the specific plan that best suits your healthcare needs and budget.

- Pay the applicable premiums to activate your AARP secondary insurance coverage.

Coverage and Benefits: Aarp Secondary Insurance To Medicare

When it comes to coverage and benefits, AARP secondary insurance offers additional benefits that complement Medicare, providing policyholders with a more comprehensive healthcare package.

Coverage Provided by AARP Secondary Insurance

- AARP secondary insurance covers services not fully covered by Medicare, such as dental, vision, and hearing care.

- It may also cover prescription drugs, preventive care, and wellness programs, filling in the gaps left by Medicare.

- Some plans offer coverage for services like alternative therapies and home health care.

Comparison with Medicare Coverage Alone

- While Medicare covers a wide range of medical services, it may not cover certain essential services like dental, vision, and hearing care.

- With AARP secondary insurance, policyholders can enjoy a more comprehensive coverage that includes these essential services.

- Additionally, AARP secondary insurance may offer lower out-of-pocket costs for certain services compared to Medicare alone.

Additional Benefits and Services

- AARP secondary insurance may provide access to telemedicine services, allowing policyholders to consult with healthcare providers remotely.

- Some plans offer fitness and wellness programs to help policyholders maintain their health and well-being.

- Policyholders may also have access to discounts on prescription drugs and other healthcare services through AARP’s network of providers.

Cost and Premiums

When considering adding AARP secondary insurance to Medicare, it’s important to understand the cost implications and how premiums are determined. Additionally, knowing how cost-sharing works between Medicare and AARP secondary insurance can help you make an informed decision.

Premium Determination

Premiums for AARP secondary insurance are typically determined based on factors such as age, location, and the specific plan you choose. These premiums are separate from your Medicare premiums and may vary depending on these factors. It’s essential to compare different plans to find one that fits your budget and provides the coverage you need.

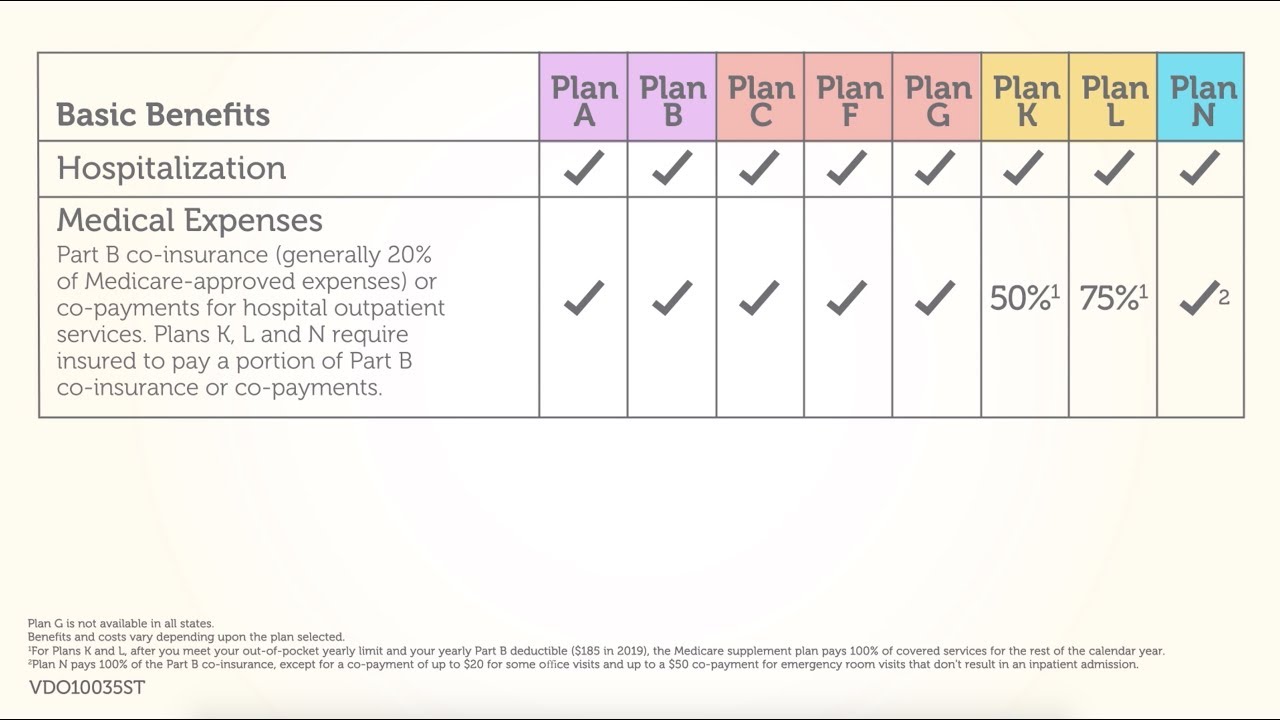

Cost-Sharing with Medicare

When you have both Medicare and AARP secondary insurance, cost-sharing comes into play. Medicare typically pays its share of the approved amount for covered services, and then AARP secondary insurance may cover some or all of the remaining costs, depending on the plan. This can help reduce your out-of-pocket expenses for healthcare services, including copayments, coinsurance, and deductibles.

- Medicare Part A and AARP secondary insurance: AARP may cover costs like hospital stays, skilled nursing facility care, and hospice care that Medicare Part A doesn’t fully cover.

- Medicare Part B and AARP secondary insurance: AARP may help cover costs for doctor visits, outpatient care, medical supplies, and preventive services that Medicare Part B partly covers.

- Prescription drugs (Part D) and AARP secondary insurance: AARP may offer prescription drug coverage that works alongside Medicare Part D, helping to lower your drug costs.

Network Providers and Accessibility

When it comes to AARP secondary insurance to Medicare, understanding the network of healthcare providers and their accessibility is crucial for individuals seeking quality care. Let’s delve into how network providers are identified and accessed with AARP secondary insurance.

Network of Healthcare Providers

- AARP secondary insurance typically partners with a wide network of healthcare providers, including hospitals, doctors, specialists, and other medical professionals.

- These network providers have agreements with AARP to provide services to members at discounted rates, ensuring cost-effective and quality care.

- Members can easily access these network providers for a range of medical needs, from routine check-ups to specialized treatments.

Accessibility for Individuals

- Individuals with AARP secondary insurance can enjoy convenient access to network providers without the hassle of referrals or pre-approvals in most cases.

- Having a robust network of providers ensures that members have a variety of options for healthcare services, promoting flexibility and choice in their medical care.

- Emergency care is also covered within the network, offering peace of mind to members in urgent situations.

Finding and Choosing Network Providers

- Members can easily find network providers by using the online directory or contacting AARP’s customer service for assistance.

- When choosing a network provider, factors such as location, specialty, and patient reviews can help individuals make informed decisions about their healthcare providers.

- It is essential to confirm that a provider is part of the network before seeking services to maximize insurance coverage and minimize out-of-pocket expenses.

Summary

In conclusion, understanding the nuances of AARP secondary insurance to Medicare can empower individuals to make informed decisions about their healthcare coverage, ensuring they receive the best possible benefits and services tailored to their needs.

Query Resolution

Who is eligible for AARP secondary insurance to Medicare?

Individuals aged 65 and older who are enrolled in Medicare Part A and Part B are typically eligible for AARP secondary insurance.

How are premiums for AARP secondary insurance determined?

Premiums for AARP secondary insurance are usually based on factors such as age, location, and the specific plan chosen.

What additional benefits does AARP secondary insurance offer?

AARP secondary insurance may provide benefits like vision and dental coverage, prescription drug discounts, and wellness programs.