Starting with Humana Health Insurance Medicare Supplement, this insurance plan offers a wide range of benefits and coverage options for Medicare recipients. With a focus on quality care and customer satisfaction, Humana stands out as a reliable choice in the healthcare insurance market.

As we delve into the specifics of what Humana Health Insurance Medicare Supplement entails, you’ll discover a wealth of information that can help you make an informed decision about your healthcare coverage.

Overview of Humana Health Insurance Medicare Supplement

Humana Health Insurance Medicare Supplement offers additional coverage to fill the gaps in Original Medicare, providing peace of mind and financial protection for healthcare expenses.

Benefits of Choosing Humana Health Insurance for Medicare Supplement Coverage

- Access to a wide network of healthcare providers and facilities

- Predictable out-of-pocket costs for covered services

- No referrals needed to see specialists

- Coverage for emergency care when traveling outside the U.S.

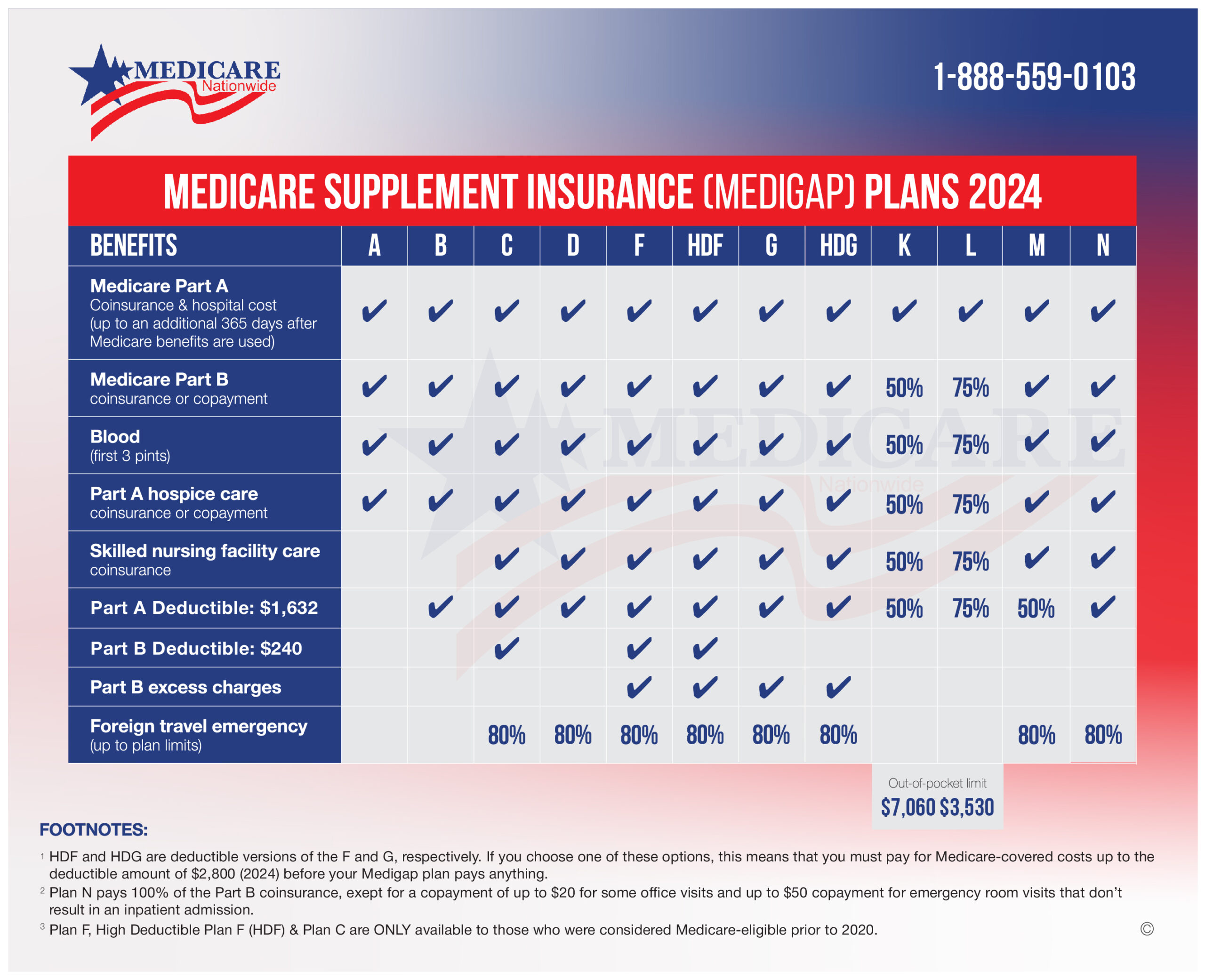

Coverage Options Available through Humana Health Insurance

Humana Health Insurance offers various coverage options tailored to individual needs and budget, including:

- Medicare Supplement Plan A: Basic coverage for essential benefits

- Medicare Supplement Plan F: Comprehensive coverage for all Medicare-approved expenses

- Medicare Supplement Plan G: High-deductible option with lower monthly premiums

- Medicare Supplement Plan N: Cost-sharing option with lower premiums and some out-of-pocket costs

Comparison with Other Medicare Supplement Plans

When comparing Humana Health Insurance Medicare Supplement with other insurance providers, it is important to consider both the cost and coverage offered. Each provider may have unique features that set them apart in the market.

Differentiation from Other Insurance Providers

- Humana Health Insurance Medicare Supplement offers a wide range of plans to choose from, catering to different needs and budgets.

- Humana has a strong network of healthcare providers, ensuring access to quality care for its members.

- Customer service and support are key strengths of Humana, providing assistance and guidance throughout the insurance process.

Cost and Coverage Comparison

- When comparing the cost of Humana Health Insurance Medicare Supplement with competitors, it is important to consider premiums, deductibles, and out-of-pocket expenses.

- Humana offers competitive rates and comprehensive coverage, making it a popular choice among Medicare beneficiaries.

- Coverage options may vary between providers, so it is essential to review the benefits and limitations of each plan before making a decision.

Unique Features of Choosing Humana Health Insurance

- Humana Health Insurance Medicare Supplement plans may include additional benefits such as fitness programs, vision and dental coverage, and prescription drug discounts.

- Humana’s focus on preventive care and wellness programs sets it apart from other providers, promoting healthy living and proactive healthcare management.

- Members of Humana Health Insurance have access to personalized care coordination services, helping them navigate the healthcare system more effectively.

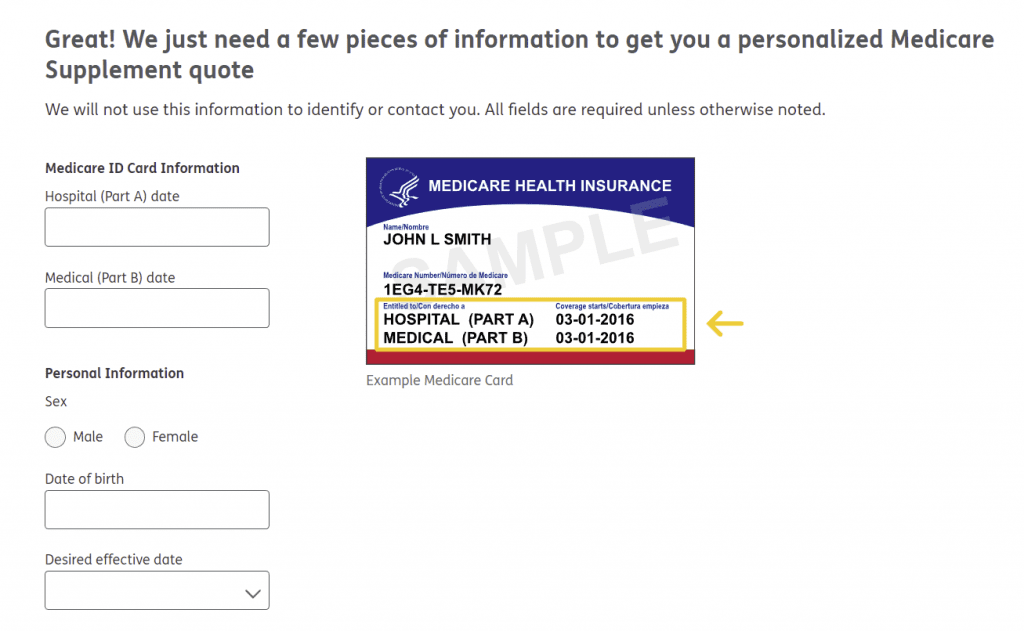

Enrollment Process and Eligibility

When it comes to enrolling in Humana Health Insurance Medicare Supplement, it’s essential to understand the eligibility criteria and the steps involved in the enrollment process.

Eligibility Criteria

To be eligible for enrolling in Humana Health Insurance Medicare Supplement, you must meet the following criteria:

– You must be enrolled in Medicare Part A and Part B.

– You must reside in the state where the plan is offered.

– You must be at least 65 years old, or under 65 with certain disabilities.

Enrollment Process

The enrollment process for Humana Health Insurance Medicare Supplement typically involves the following steps:

- Research and Compare Plans: Start by researching different Medicare Supplement plans offered by Humana and compare them to find the one that best fits your needs.

- Contact Humana: Reach out to Humana either online or by phone to start the enrollment process.

- Provide Information: You will need to provide personal information such as your name, address, Medicare number, and other relevant details.

- Choose a Plan: Select the specific Humana Health Insurance Medicare Supplement plan that you wish to enroll in based on your healthcare needs and budget.

- Submit Application: Complete and submit the enrollment application either online, by mail, or over the phone.

- Review and Confirm: Review the information provided in the application for accuracy and confirm your enrollment in the chosen plan.

Requirements and Documents

During the enrollment process, you may be required to provide the following documents:

– Medicare card

– Identification documents such as a driver’s license or passport

– Proof of address

– Any other documentation requested by Humana for enrollment purposes

Network Coverage and Healthcare Providers

When it comes to Humana Health Insurance Medicare Supplement, network coverage plays a crucial role in determining where policyholders can receive healthcare services. Understanding the network of healthcare providers and facilities included in Humana’s coverage is essential for making informed decisions about healthcare options.

Network Coverage Details, Humana health insurance medicare supplement

- Humana Health Insurance Medicare Supplement offers a wide network of healthcare providers, including doctors, specialists, hospitals, and clinics.

- Policyholders have the flexibility to choose healthcare providers within the Humana network, ensuring access to quality care.

- Out-of-network coverage may be available in certain circumstances, but at higher out-of-pocket costs for policyholders.

Healthcare Providers and Facilities

- The network of healthcare providers in Humana’s coverage includes primary care physicians, specialists such as cardiologists and oncologists, as well as various hospitals and outpatient facilities.

- Policyholders can access a diverse range of healthcare services within the Humana network, from routine check-ups to specialized treatments.

- Having a wide network of healthcare providers ensures that policyholders have options and can choose providers that best meet their healthcare needs.

Impact on Choice of Providers

- Network coverage directly impacts the choice of healthcare providers for policyholders, influencing where they can seek medical care and the associated costs.

- By selecting providers within the Humana network, policyholders can benefit from negotiated rates and lower out-of-pocket expenses.

- Policyholders should carefully consider the network coverage when choosing healthcare providers to optimize benefits and minimize costs.

Final Review: Humana Health Insurance Medicare Supplement

In conclusion, Humana Health Insurance Medicare Supplement provides extensive coverage and flexible options that cater to the diverse needs of Medicare beneficiaries. By choosing Humana, you can rest assured that your healthcare needs are in good hands.

FAQ Section

What does Humana Health Insurance Medicare Supplement offer?

Humana Health Insurance Medicare Supplement offers comprehensive coverage options tailored to the needs of Medicare recipients, including various benefits and services.

How does Humana Health Insurance compare to other providers?

Humana Health Insurance sets itself apart from other providers with its unique features, competitive costs, and extensive network coverage, making it a top choice in the market.

What are the eligibility criteria for enrolling in Humana Health Insurance Medicare Supplement?

To enroll in Humana Health Insurance Medicare Supplement, individuals must meet specific eligibility requirements based on age, location, and Medicare enrollment status.

Can policyholders choose their healthcare providers with Humana Health Insurance?

Yes, policyholders can select healthcare providers from Humana’s network, which includes a wide range of healthcare facilities and professionals for their medical needs.