Best insurance rates in NC are crucial for anyone looking to secure cost-effective coverage without compromising on quality. Navigating the complex world of insurance rates in North Carolina can be challenging, but with the right knowledge and strategies, you can find the perfect policy that fits your needs and budget.

Exploring the various factors, types of insurance available, and practical tips for obtaining the best rates will empower you to make informed decisions and save money in the long run.

Factors Influencing Insurance Rates in North Carolina

Understanding the key factors that influence insurance rates in North Carolina is crucial for individuals looking to secure the best rates for their coverage needs. Various factors come into play when determining insurance premiums, and being aware of these can help policyholders make informed decisions.

Location

The location where you reside in North Carolina can significantly impact your insurance rates. Urban areas with higher population densities and increased crime rates may lead to higher premiums compared to rural areas with lower risks of accidents or theft.

Driving Record

Your driving record plays a significant role in determining your insurance rates. Individuals with a history of accidents or traffic violations are considered higher risk and may face higher premiums. On the other hand, safe drivers with a clean record are often rewarded with lower rates.

Age and Gender

Age and gender are also important factors that insurers consider when calculating rates. Younger drivers and male drivers tend to face higher insurance costs due to statistical data showing a higher likelihood of accidents within these demographics.

Type of Vehicle

The type of vehicle you drive can impact your insurance rates as well. Luxury cars, sports cars, and vehicles with high theft rates or expensive repair costs typically result in higher premiums compared to more affordable and safer vehicle models.

Credit Score

In North Carolina, insurance companies may also take your credit score into account when determining your rates. Individuals with lower credit scores may face higher premiums as they are perceived as higher risk policyholders.

Coverage Limits

The coverage limits you choose for your insurance policy can also influence your rates. Opting for higher coverage limits and additional endorsements may lead to increased premiums, while choosing lower limits can result in more affordable rates.

Claims History

Your past claims history can impact your insurance rates as well. Individuals who have filed multiple claims in the past may be viewed as higher risk and face higher premiums compared to those with a clean claims record.

Conclusion, Best insurance rates in nc

By understanding these key factors that influence insurance rates in North Carolina, individuals can take proactive steps to potentially lower their premiums. Shopping around, maintaining a clean driving record, and being mindful of the impact of different factors can help policyholders secure the best rates for their insurance needs.

Types of Insurance Available in North Carolina: Best Insurance Rates In Nc

Insurance is an essential financial protection tool that helps individuals and businesses safeguard against unexpected events. In North Carolina, there are various types of insurance available to meet different needs and requirements.

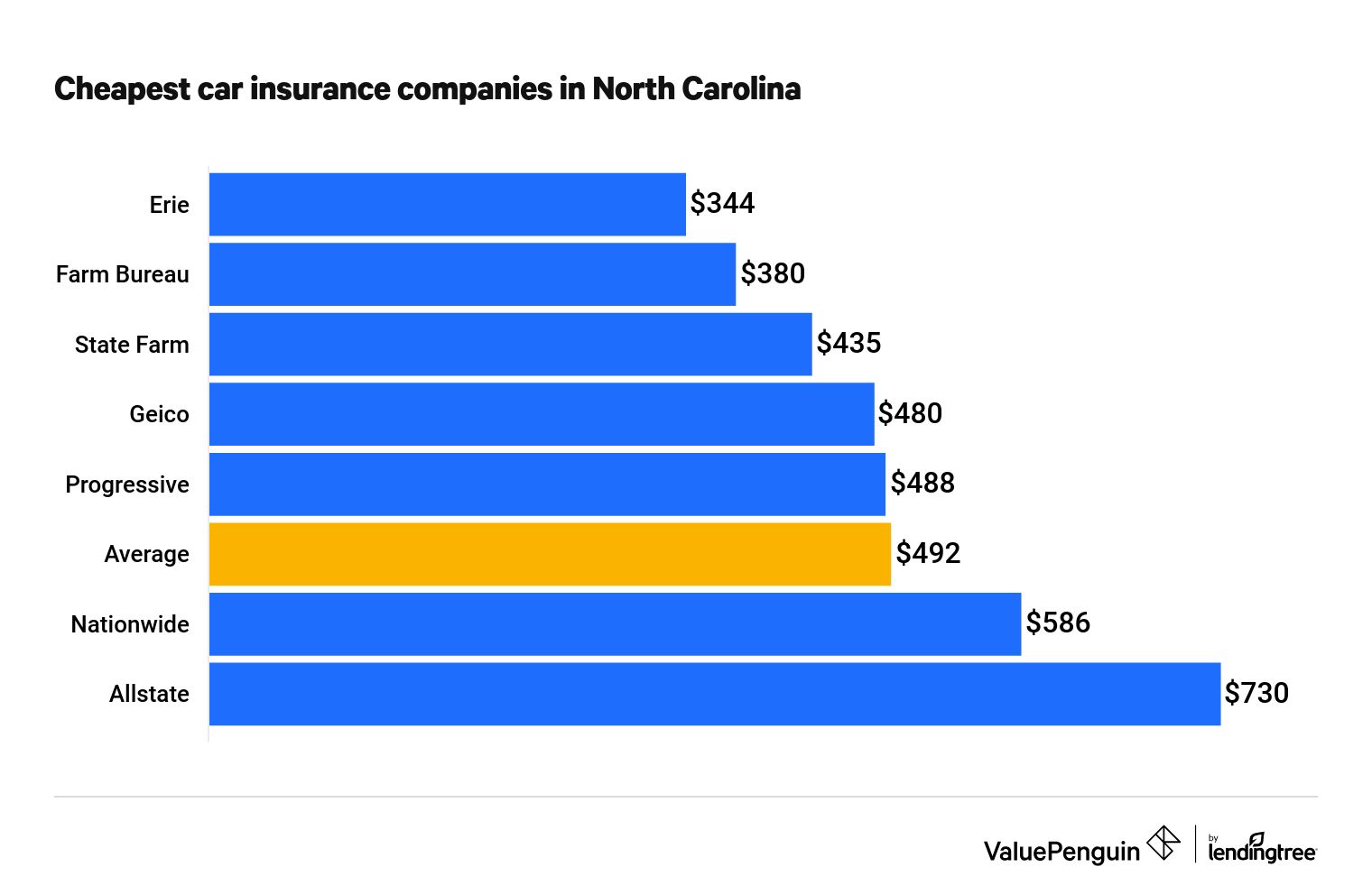

Auto Insurance

Auto insurance is mandatory in North Carolina and is designed to cover the costs associated with car accidents, theft, and other damages. Factors that can affect auto insurance rates include driving history, age of the driver, type of vehicle, and coverage limits. To secure the best rates for auto insurance, maintaining a clean driving record and opting for higher deductibles can be beneficial.

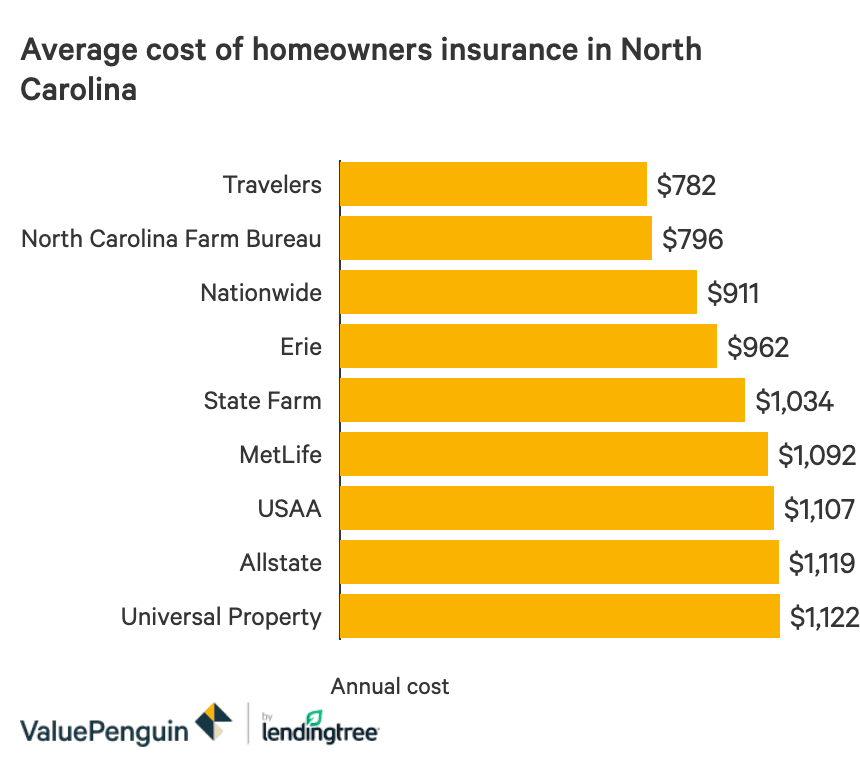

Homeowners Insurance

Homeowners insurance provides coverage for damages to a home and personal belongings caused by perils such as fire, theft, or natural disasters. The location of the home, its age, the materials used in construction, and the coverage amount can influence homeowners insurance rates. Bundling policies, installing security systems, and maintaining a good credit score are strategies to obtain favorable rates for homeowners insurance.

Health Insurance

Health insurance helps individuals cover medical expenses and offers financial protection against unexpected healthcare costs. Factors that impact health insurance rates include age, pre-existing conditions, coverage type, and network providers. To find the best rates for health insurance in North Carolina, comparing plans from different providers and considering subsidies or tax credits can be beneficial.

Life Insurance

Life insurance provides financial support to beneficiaries in the event of the policyholder’s death. The coverage amount, age, health status, and type of policy (term or whole life) can influence life insurance rates. To secure the best rates for life insurance, maintaining good health habits, avoiding risky activities, and comparing quotes from multiple insurers are recommended.

Business Insurance

Business insurance protects companies against financial losses resulting from property damage, liability claims, or other risks. The type of business, industry, location, revenue, and coverage needs can impact business insurance rates. To obtain the best rates for business insurance in North Carolina, implementing risk management strategies, maintaining a safe work environment, and working with an experienced insurance agent can be advantageous.

Tips for Finding the Best Insurance Rates in NC

When looking for the best insurance rates in North Carolina, it’s important to compare various options, leverage discounts, and negotiate effectively with insurance providers. Below are some tips to help you secure the most competitive rates:

Strategies for Comparing Insurance Rates Effectively

- Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Consider working with an independent insurance agent who can provide access to a variety of carriers.

- Review the coverage limits, deductibles, and exclusions of each policy to ensure you’re getting the best value for your money.

Role of Discounts in Obtaining Lower Insurance Rates

- Ask about available discounts such as bundling multiple policies, maintaining a good driving record, or installing safety devices in your home or car.

- Check if you qualify for any group discounts through memberships in organizations or affiliations with certain groups.

- Keep an eye out for loyalty discounts for customers who have been insured with the same company for an extended period.

Tips on How to Negotiate for Better Rates with Insurance Providers

- Be prepared to negotiate with insurance companies by highlighting your loyalty, good credit score, or low-risk profile.

- Ask about any available promotions or special deals that could lower your premium rates.

- Consider adjusting your coverage limits or deductibles to find a balance between affordability and adequate protection.

Understanding the Insurance Market in North Carolina

In North Carolina, the insurance market plays a crucial role in determining the rates that consumers pay for various types of insurance coverage. Several factors contribute to the dynamics of the insurance market in the state, influencing the pricing and availability of insurance products.

Competition Among Insurance Providers

Competition among insurance providers in North Carolina creates a diverse marketplace where consumers can compare rates and coverage options. As insurance companies compete for customers, they may adjust their prices to attract and retain policyholders. This competition can lead to lower insurance rates for consumers in the state.

Regulatory Factors Impacting Insurance Pricing

Regulatory factors set by the state government also play a significant role in shaping the insurance market in North Carolina. Regulations related to insurance rates, coverage requirements, and consumer protection impact how insurance companies operate and price their products. For example, state laws governing insurance practices can influence the cost of insurance premiums and the types of coverage available to consumers.

Final Summary

In conclusion, understanding the dynamics of insurance rates in NC is key to securing the best possible coverage at affordable prices. By utilizing the insights gained from this guide, you can confidently navigate the insurance market and make smart choices for your financial well-being.

Essential FAQs

What factors influence insurance rates in North Carolina?

Factors like age, driving record, type of coverage, and location can impact insurance rates in NC.

How can I find the best insurance rates in NC?

Comparing rates, leveraging discounts, and negotiating with insurance providers are effective strategies for finding affordable rates in NC.

Which types of insurance are commonly sought after for the best rates in NC?

Auto insurance, home insurance, and health insurance are commonly sought after for the best rates in NC due to their widespread availability and competitive pricing.